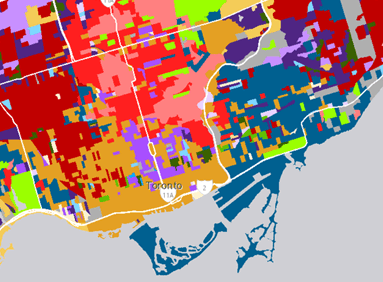

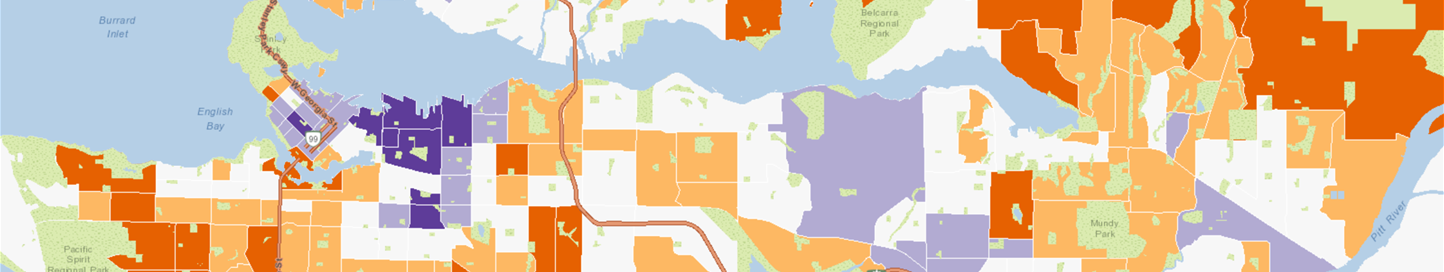

Financial Vulnerability Index

Understand the changing affordability landscape in Canada

The Financial Vulnerability Index (FVI) helps government, social services and private industry sectors to understand the populations most at risk financially during the COVID-19 pandemic. The FVI helps identify which Canadians are most likely to have difficulty meeting financial obligations like housing, necessities and manage their debt after a sudden loss of income. Understanding the kinds of populations most likely to be in trouble at a local level allows financial service providers, retailers, utilities and governments to respond with more effectively designed initiatives tailored to meet these populations’ needs.

The FVI looks at a range of household financial indicators, including savings and liquid assets, levels of debt, discretionary income and the ratio of debt to discretionary income to score how precarious a typical household’s finances are at the neighbourhood level. The FVI is calculated by weighting variables across multiple Environics Analytics databases, including WealthScapes, HouseholdSpend and Liquid Assets.Understand who is at risk

Identify households most vulnerable to financial instability

Score financial wellness

Rank your customers' financial health to understand how best to support them

Tailor your response

Design initiatives to meet the specific needs of those who are most vulnerable

Want to know more about the Financial Vulnerability Index?

We're here to help.

Understand Populations Most at Risk Financially Due to the COVID-19 Pandemic

Answer common questions like:

• Which neighbourhoods are the most financially vulnerable?

• How many households in my jurisdiction will likely need support? How can we rank them based on need?

• Where can we allocate our resources for minimum investment and maximum impact?

• Which segments are likely to fall behind on their payments? What is the best way to reach out and support them?

Respond With Effectively Designed Initiatives

• Financial services and retailers can ensure they are providing supports and products that consider a changing affordability landscape

• Public sector and community-based organizations can provide support in a targeted way, reducing unnecessary spending and focusing subsidies to those who need them most

• Retailers can rethink product support based on their local communities’ financial profiles

• Utilities, telcos and other service providers can map those most likely to need more time to pay their bills

Find more information about the Financial Vulnerability Index including metadata and release notes on our community website

Ready to turn data into actionable insights for your business?

More Data to Choose From

Enhance your understanding of the financial behaviour of Canadians and develop a comprehensive picture of their assets, liabilities and net worth.

A comprehensive database for information on the assets, liabilities and income of Canadians and designed for financial planning, marketing and targeting applications.

Understand financial wellness by age to gain insight into the challenges and opportunities customers are likely to experience at different life stages.

Identify prospective donors that are likely to receive an inheritance and potentially a greater capacity to donate.

PRIZM segmentation classifies Canadians into 67 unique lifestyle types to help you better analyze and understand your prospects and customers.

Financial Vulnerability Index

Financial Vulnerability Index