Banking

Improve customer experience in banking

Use evidence-based decision making to meet the emerging needs of your customers. Data analytics can help you identify hidden opportunities, accelerate customer engagement, prioritize offers, influence digital adoption and identify at-risk customers. Whether you are a national, regional or community bank, we have the expertise to help you create customer-centric, scalable solutions for the rapidly changing financial services sector.

Improve customer experience in banking

Use evidence-based decision making to meet the emerging needs of your customers. Data analytics can help you identify hidden opportunities, accelerate customer engagement, prioritize offers, influence digital adoption and identify at-risk customers. Whether you are a national, regional or community bank, we have the expertise to help you create customer-centric, scalable solutions for the rapidly changing financial services sector.

Enhance acquisition and the customer journey

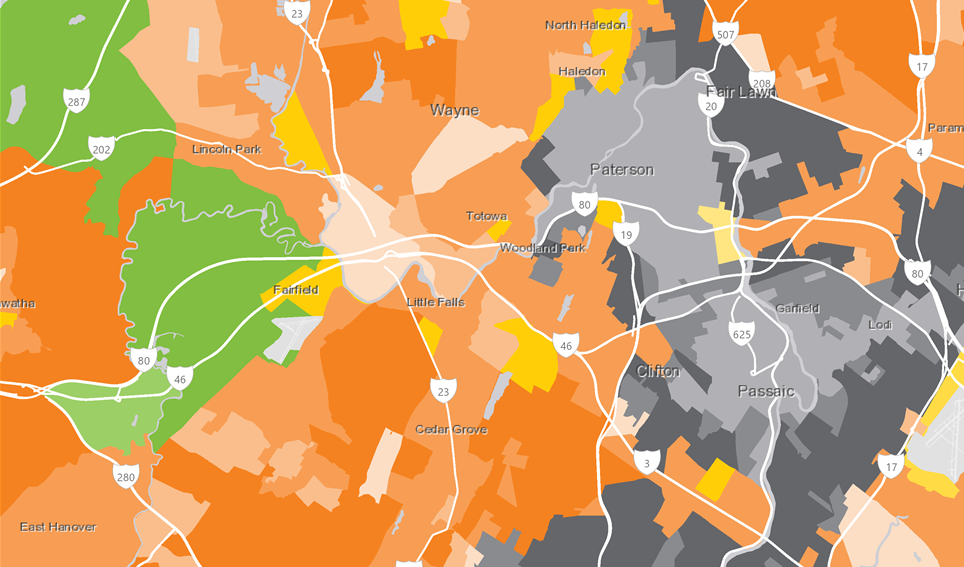

Develop custom segments that leverage your brand equity and align with your strategic goals and objectives. Create rich personas to improve customer experience and increase engagement. Bolster acquisition efforts by locating prospective customers and identifying new markets most likely to respond to your value proposition.

Improve your engagement strategy and gain efficiencies

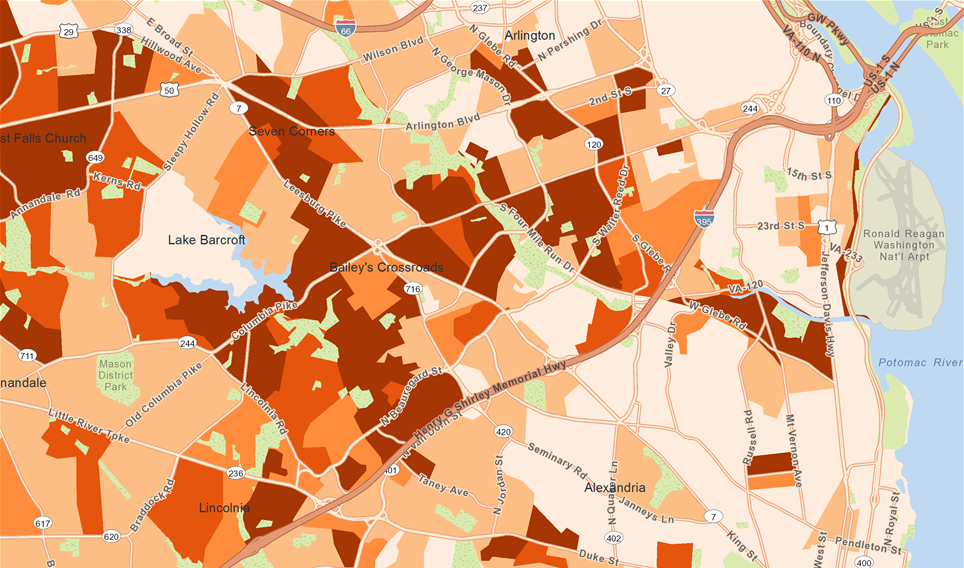

Model your customers' potential value to prioritize your resources and customize your services and meet their individual needs. Predict the next best offer to find new revenue streams and proactively identify and engage at-risk customers.

Optimize your network and channel strategy

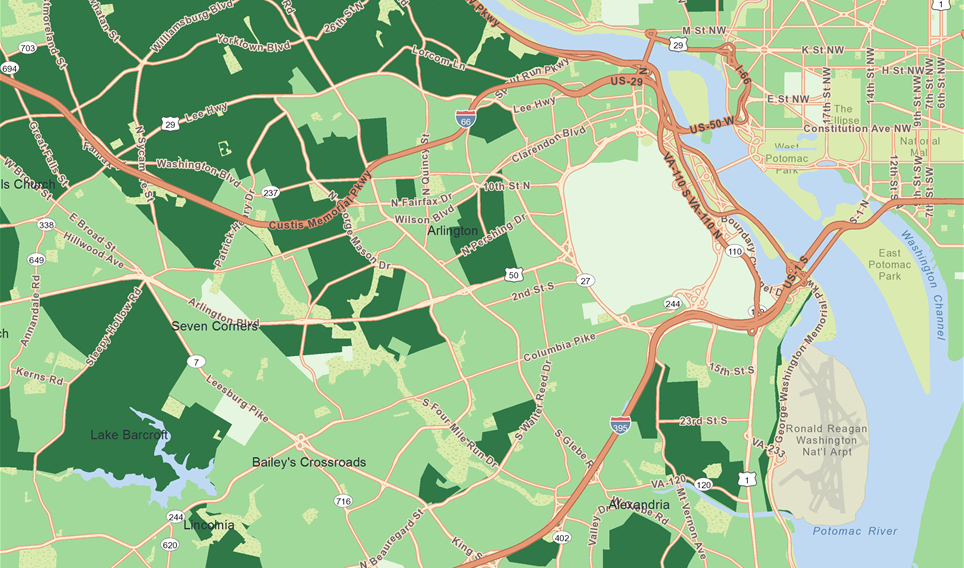

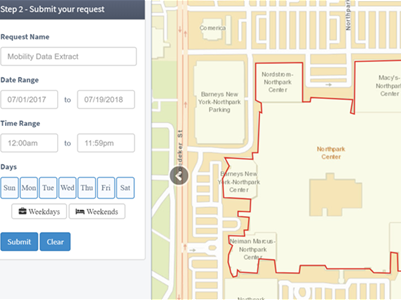

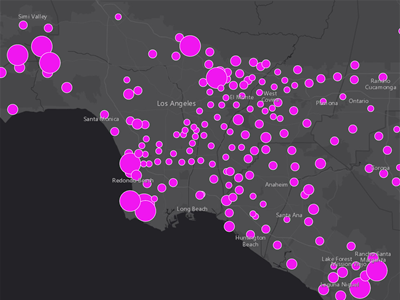

Identify the drivers that influence the adoption of web and mobile banking while optimizing your distribution strategy. Gain deeper insights into the market potential to identify areas of opportunity and underserved markets. Analyze mobility data to understand visitor patterns at your branches and those of your competitors.

Financial Services Expertise

Our consultants have the strategic expertise and sector experience to help address your key business challenges. Many of our clients work with us as a seamless extension of their team and think of us as their competitive advantage.

Meet Sean Moloney

Senior Vice President and Practice Leader

As Senior Vice President & Practice Leader, Sean Moloney leads our business development and sales practice in the United States. With over twenty-five years of experience in the marketing analytics industry, Sean helps organizations turn data and analytics into insight, which becomes the foundation for an effective strategy. In his role, Sean leverages his extensive knowledge of geodemographics, segmentation, and advanced analytics to help clients combine different data types with business analytics tools and techniques to deliver results. Before joining Environics Analytics, Sean held analytics, sales executive and national account manager roles at Pitney Bowes Software, MapInfo and Compusearch. Sean earned a Bachelor of Applied Arts in Applied Geography degree from Ryerson University.

Want to know more about our Products and Services?

Get in touch. We're ready to help.

We Know Data

Enhance your store data with our privacy compliant, authoritative databases. Choose from over 30 databases including financial, demographic, segmentation and behavioral data. Here are a few of our popular databases that support the needs of the financial services industry.

Claritas Financial CLOUT® contains current-year and five-year projections of market penetration and dollar balances for more than 100 financial products including checking accounts, investments, credit cards, lines of credit and savings products.

Create a comprehensive picture of your customers according to shared demographic, lifestyle and behavioral traits. Discover where they live and understand their preferences to create more effective marketing strategies.

Track neighborhood growth patterns and forecast trends with demographic data covering gender, age, education, housing, cultural diversity, occupation, income levels and marital status. Data available across a wide range of census and geographic areas.

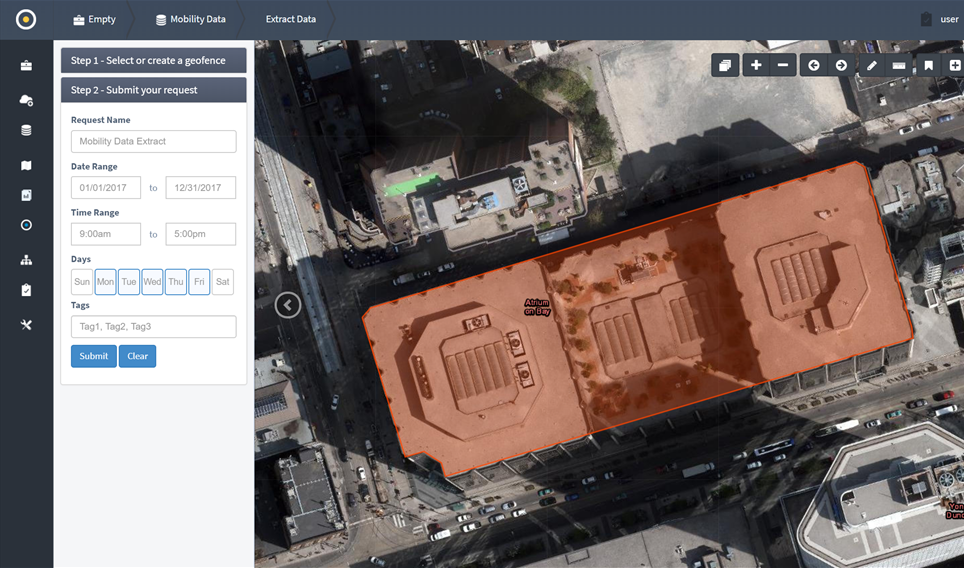

Enhance what you know about who walks into a branch or may have witnessed strategically placed outdoor advertising. Mobile data can be instrumental in site selection by identifying areas of higher potential value based on visitor patterns.

Frequently Asked Questions

Why Us

We’ve got the expertise to help. With decades of leadership and experience in the industry, we are the only analytics firm in Canada to offer our broad range of privacy compliant, consumer and business databases, proprietary software and team of industry professionals.

15 Years +

Corporate Growth

200+

Employees

2000 +

Clients

10 Offices

Across North America

Over 40

Industry Partnerships

Meeting the highest standards of data security

Financial Services Industry Insights and Trends

Our industry experts publish timely analysis of government data releases, opinions on industry trends and insights on how organizations are embracing big data and analytics to help you stay informed.

How the data-rich financial sector can benefit from mobile analytics.